According to the research conducted by meAAns, the observatory on market relations in the design-furniture sector, applying an ad hoc indicator developed to summarize – with the inclusion of a series of digital performance variables – the degree of activity in a given time period inside sector brands.

The focus of this in-depth study is on European producers of decorative lighting solutions: about 150 companies have been monitored and weighted in terms of number of visits to their websites, bounce rate (to gauge the quality of visits), average visit length, but also number of social network followers, likes and comments, engagement and other variables that all go into analysis of the digital appeal of a brand.

Getting to the ranking for this second quarter of 2023 and using terminology borrowed from Formula 1: in the front row there are two competitors from the Design Holding team, where Flos takes pole position – by quite a margin (see the infographic) – over the Danish teammate Louis Poulsen.

The big surprise of the list comes in the positions from third to fifth place: the lower step of the podium is occupied by Seletti, the Viadana-based company known for having developed, together with Marcantonio and other young designers, a catalogue of imaginative lighting projects over the years, drawing on the world of animals and pop culture.

Fourth place goes to Santa & Cole, the small independent and global company that creates well-designed products – as they express it – founded at Belloch (Barcelona) in 1985.

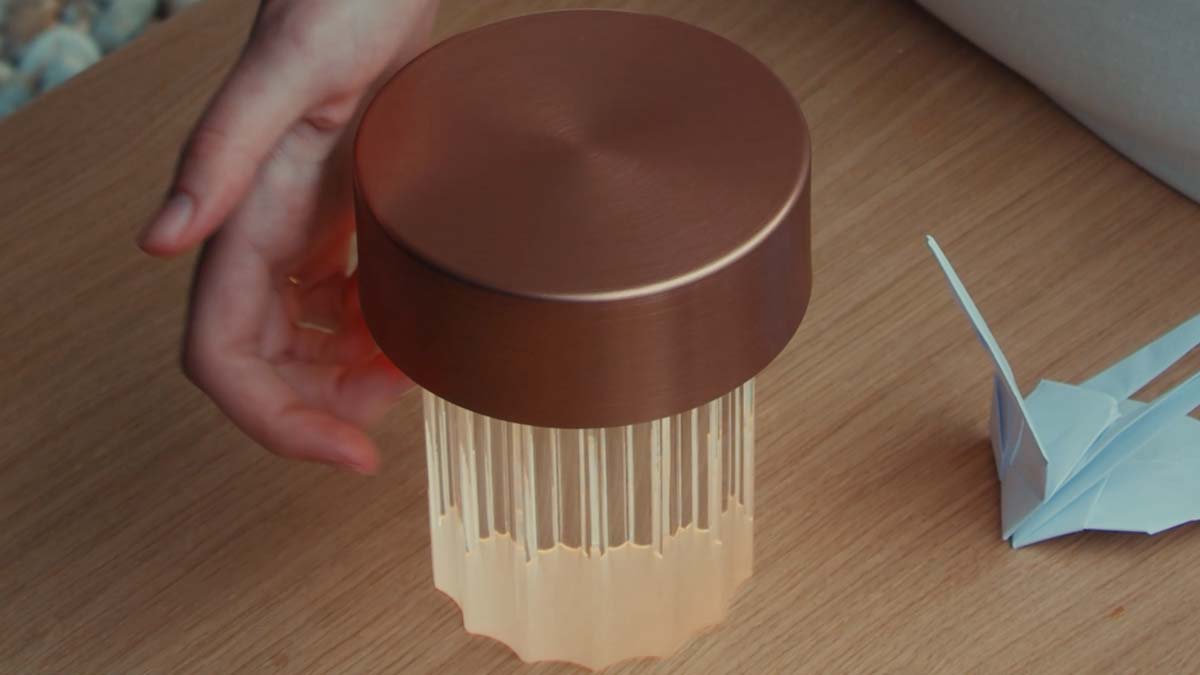

The fifth leading firm is Lee Broom, founded in London by the designer of the same name, which has outstanding performance in the area of social media (followers, likes, comments, engagement, etc.); but this company has lower performance than its direct competitors in the variables linked to corporate websites

We should emphasize that with the exception of the first two companies, the other top performers (Seletti, Santa & Cole and Lee Broom) also offer other types of products in their collections, which cannot be categorized as “decorative lighting,” such as accessories, furniture and so on.

For this reason, another ranking has been created, eliminating from the list brands that offer different types of products, over and above decorative lighting. It is legitimate to assume that a large part of the digital performance of brands like Seletti, Lee Broom or Kartell (seventh in the overall list) is also driven, for example, by users interested in furniture and design objects.

In this second ranking Flos and Louis Poulsen obviously continue to hold the first two slots. Third place goes to the Spanish company Vibia, fourth to Artemide, the company founded in 1960 by Ernesto Gismondi (ninth in the overall ranking). Fifth place is for Davide Groppi, of the recently bourse-listed group Italian Design Brands (tenth in the overall top ten).

If we narrow the field to include manufacturers of only lighting and only based in Italy, Flos is followed by Artemide, Davide Groppi, then Foscarini (13th in general) and Catellani & Smith (23rd in general).

Together with the in-depth report on lighting brands, the firm has also released a ranking for the second quarter 2023 of soft furniture makers, for which (also on IFDM) data were published related to the first quarter.

Some interesting new perspectives emerge: while the first three spots remain the same (Hay, Vitra and Minotti), fourth place is now held by Poliform (sixth in the previous quarter), while the fifth rank is occupied by B&B Italia (dropping by one position), which now takes the place of Cassina, slipping down to 12th place in the second quarter of 2023, behind Knoll and just slightly ahead of Fritz Hansen.

Special notice should be taken of the French company Ligne Roset, which is the brand that has climbed up the most steps from the first to the second quarter, passing from 37th to 10th place in the general survey.

Concentrating only on Italian companies, the three steps on the podium are filled – in order – by Minotti, Poliform and B&B Italia, while fourth place goes to Poltrona Frau, rising by as many as four spots (it was 8th among the Italians in the previous survey), and fifth place is held by Molteni&C. (10th among Italians in the previous quarter).

meAAns is an observatory on market relations in the specific field of design and furnishings, founded in 2022 by Andrea Mamprin and Massimo Marchesin. Together, from 2002 to 2007 they worked under the guidance of Paolo Feltrin at the institute of socio-political research Tolomeo Studi e Ricerche, and the associated institute of socio-economic research CERSA (Centro Europeo Ricerche e Studi Avanzati). They joined forces in 2021 with the aim of applying the methods of market research to the field of design and furniture.

This mark involves a wide range of interactions, exchanges and stakeholders, converging in a single ecosystem. meAAns is actively monitoring this market to capture insights, with the aim of helping companies to understand its workings in a more strategic way.